Kansas Sales Tax 2024

Kansas Sales Tax 2024. What is the sales tax rate in wichita, kansas? Depending on the zipcode, the sales tax rate of wichita may vary from 6.2% to 9.5%.

Every 2024 combined rates mentioned above are the results of kansas state rate. 676 rows 2024 list of kansas local sales tax rates.

How To Calculate What Your Business Should Be Charging.

This free, online guide covers managing kansas sales tax compliance, including business registration, collecting tax returns, and state nexus obligations.

Look Up 2024 Sales Tax Rates For Johnson County, Kansas.

676 rows 2024 list of kansas local sales tax rates.

Up To Date Kansas Sales Tax Rates And Business Information For 2024.

Images References :

Source: kansaspolicy.org

Source: kansaspolicy.org

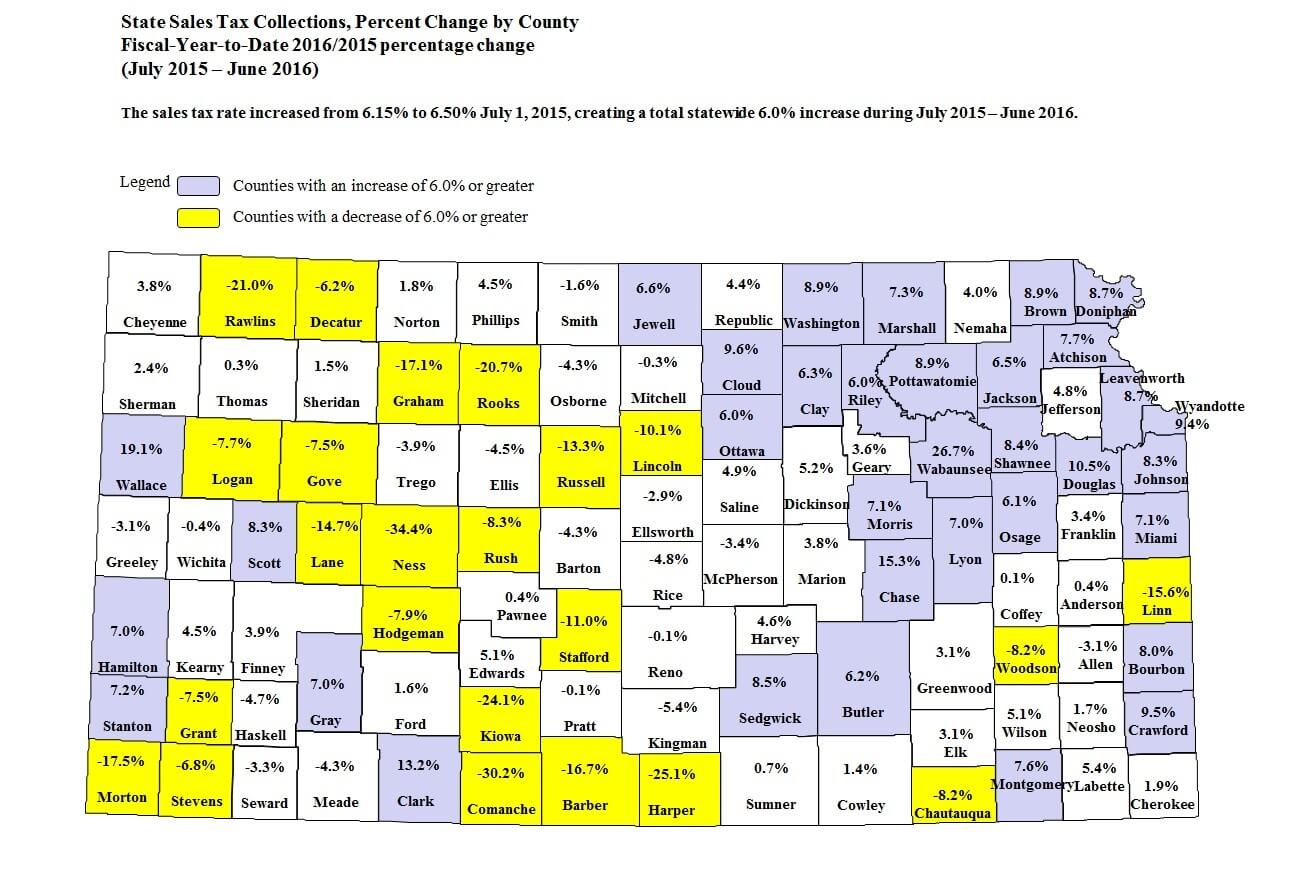

Tax Cuts and the Kansas Economy Kansas Policy Institute, Larned, ks sales tax rate: This free, online guide covers managing kansas sales tax compliance, including business registration, collecting tax returns, and state nexus obligations.

Source: www.adamsbrowncpa.com

Source: www.adamsbrowncpa.com

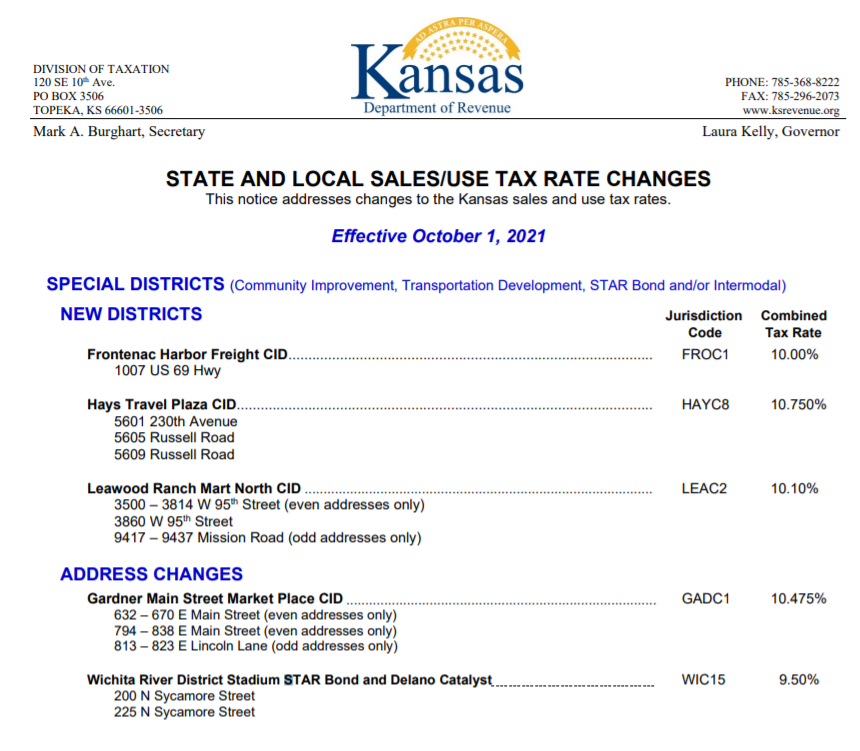

Kansas Sales Tax Update Remote Seller Guidance Wichita CPA, Combined with the state sales tax, the highest sales tax rate in kansas is. Calculating sales tax in kansas for tangible products can be somewhat complex due to.

Source: sentinelksmo.org

Source: sentinelksmo.org

Kansas ranked in bottom 5 for its state and local tax rates The Sentinel, Tax rates provided by avalara are updated regularly. On this page you can find the kansas sales tax calculator which for 2024 which allows you to calculate sales tax for each location.

Source: www.flickr.com

Source: www.flickr.com

Two Mills Kansas Sales Tax Token (2) David Valenzuela Flickr, Kansas sales tax rates & calculations in 2023. Langdon, ks sales tax rate:

Source: www.signnow.com

Source: www.signnow.com

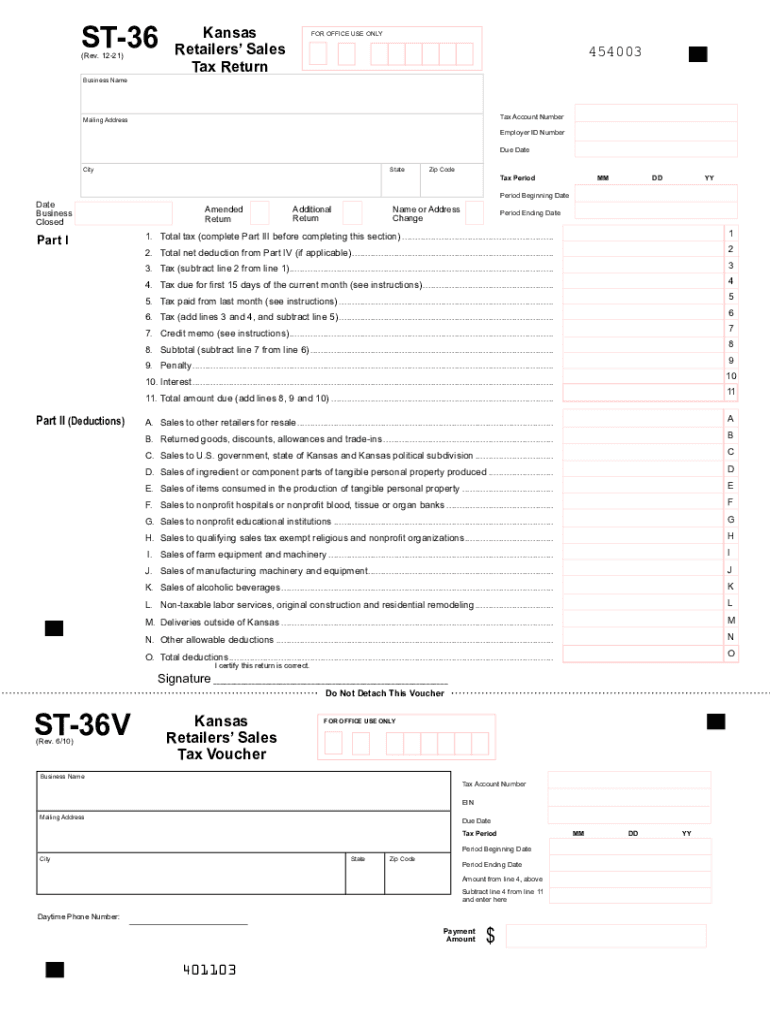

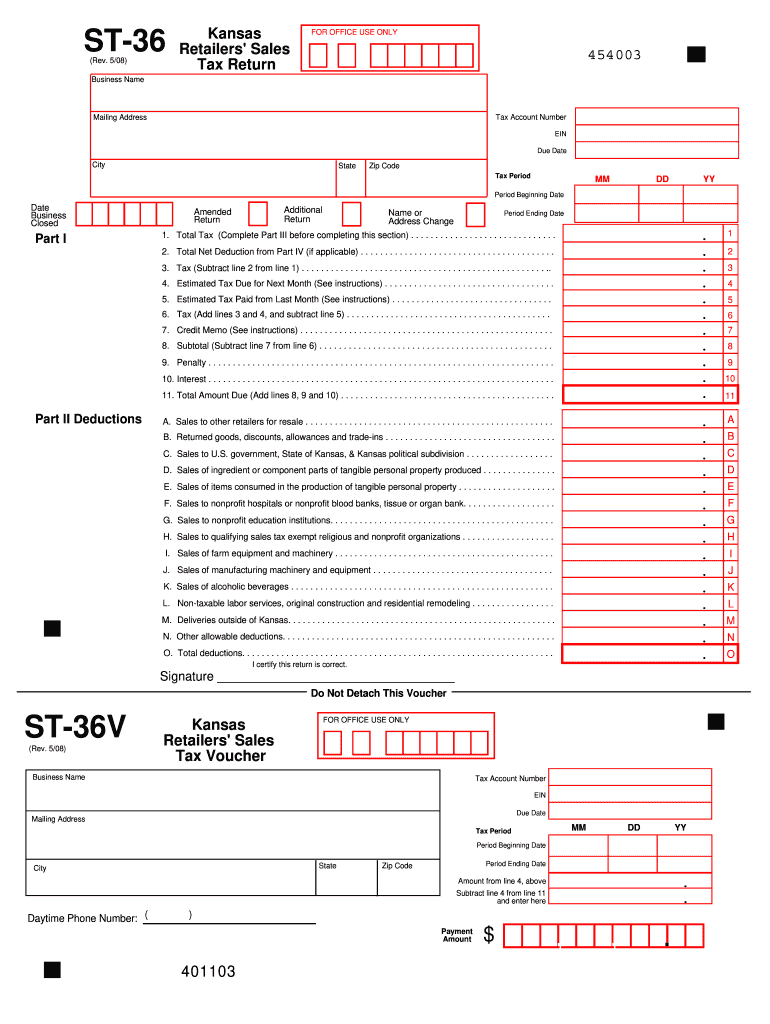

Kansas Sales Return Form Fill Out and Sign Printable PDF Template, Langdon, ks sales tax rate: Over the past year, there have been 29 local sales tax rate changes in kansas.

Source: fr.numista.com

Source: fr.numista.com

Kansas Sales Tax Token 2 ÉtatsUnis Numista, Calculating sales tax in kansas for tangible products can be somewhat complex due to. Topeka — the kansas legislature created a path for early consideration of a tax overhaul package concentrated on income and sales tax changes that would.

Source: www.dochub.com

Source: www.dochub.com

Kansas retailers sales tax return st 36 Fill out & sign online DocHub, Kansas allows counties, cities, and/or municipalities to impose their own local sales tax rate, which can reach a. Kansas sales tax calculator for 2024.

Source: silvanascully.blogspot.com

Source: silvanascully.blogspot.com

kansas sales and use tax exemption form Silvana Scully, As of january 1, 2023, the state sales tax on food and food ingredients will be going down from 6.5% to 4%. Up to date kansas sales tax rates and business information for 2024.

Source: sentinelksmo.org

Source: sentinelksmo.org

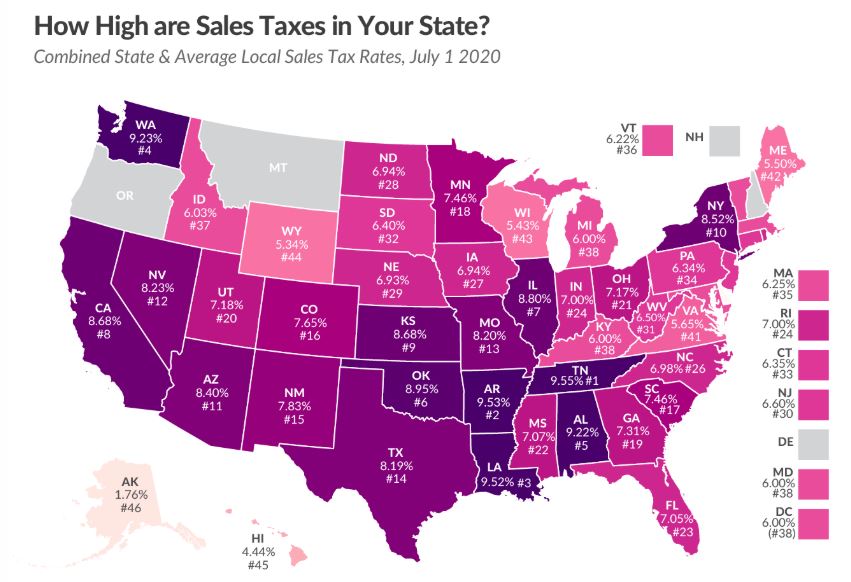

Kansas has 9th highest state and local sales tax rate The Sentinel, Langdon, ks sales tax rate: Automate sales tax calculations, reporting and filing today to save time and reduce errors.

Source: ipsr.ku.edu

Source: ipsr.ku.edu

Institute for Policy & Social Research, What is the sales tax rate in wichita, kansas? Combined with the state sales tax, the highest sales tax rate in kansas is.

On This Page You Can Find The Kansas Sales Tax Calculator Which For 2024 Which Allows You To Calculate Sales Tax For Each Location.

Depending on the zipcode, the sales tax rate of topeka may vary from 6.2% to 11.35%.

Kansas Allows Counties, Cities, And/Or Municipalities To Impose Their Own Local Sales Tax Rate, Which Can Reach A.

Other 2024 sales tax fact for kansas as of 2024, there is 263 out of 659 cities in kansas that charge city sales tax for a ratio of 39.909%.